Coronavirus Bounce Back Loan as of 04 May 2020 – Now Open for Applications

The Chancellor has announced The Bounce Back Loan scheme which will help small and medium-sized businesses to borrow between £2,000 and £50,000.

The government will guarantee 100% of the loan and there will not be any fees or interest to pay for the first 12 months.

Loan terms will be up to 6 years. No repayments will be due during the first 12 months. The government will work with lenders to agree a low rate of interest for the remaining period of the loan.

Is your business claiming funding via the CBILS?

You cannot apply if you are already claiming under the CBILS.

If you have already received a loan of up to £50,000 under CBILS and would like to transfer it into the Bounce Back Loan scheme, you can arrange this with your lender until 4 November 2020.

How to apply?

The Bounce Back Loan scheme is now open for applications. The British Business Bank has advised the application process is as follows:

1. Find a Lender

The lender has to be an accredited lender for the Bounce Back Loan Scheme (BBLS)

2. Approach the lender

You should approach the accredited lender yourself, ideally via its website.

In the first instance, you should approach your own provider. You may also consider approaching other lenders if you are unable to access the finance you require.

You will need to fill in a short application form online, which self-certifies that your business is eligible for a loan under BBLS.

If your business is eligible, it will be subject to appropriate customer fraud, Anti-Money Laundering (AML) and Know Your Customer (KYC) checks. Some state aid restrictions may apply to your application.

Note: There is high demand for finance through BBLS. Phone lines are likely to be busy and branches may not be able to handle enquiries in person.

3. The lender makes the decision

The lender has the authority to decide whether to offer you finance.

Under the scheme, lenders are not permitted to:

• take any form of personal guarantee

• take recovery action over a borrower’s personal assets (such as their main home or personal vehicle)

4. If the lender rejects your application

If one lender turns you down, you can still approach other lenders within the scheme.

BBLS is designed to be fast for lenders to process and quick and easy for businesses to access. To help achieve this, you will only be required to fill out a short application form online.

Who is eligible?

Your business must be able to self declare to the lender that it:

• has been impacted by the coronavirus (COVID-19) pandemic

• was not a business in difficulty at 31 December 2019 (if it was, you must confirm your business complies with additional state aid restrictions under de minimis state aid rules)

• is engaged in trading or commercial activity in the UK and was established by 1 March 2020

• is not using the Coronavirus Business Interruption Loan Scheme (CBILS), the Coronavirus Large Business Interruption Loan Scheme (CLBILS) or the Bank of England’s Covid Corporate Financing Facility Scheme (CCFF), unless the Bounce Back Loan will refinance the whole of the CBILS, CLBILS or CCFF facility

• is not in bankruptcy or liquidation or undergoing debt restructuring at the time it submits its application for finance

• derives more than 50% of its income from its trading activity (this requirement does not apply to charities or further-education colleges)

• is not in a restricted sector (see below)

Bounce Back Loans are available to businesses in all sectors, except the following:

• Credit institutions (falling within the remit of the Bank Recovery and Resolution Directive)

• Insurance companies

• Public-sector organisations

• State-funded primary and secondary schools

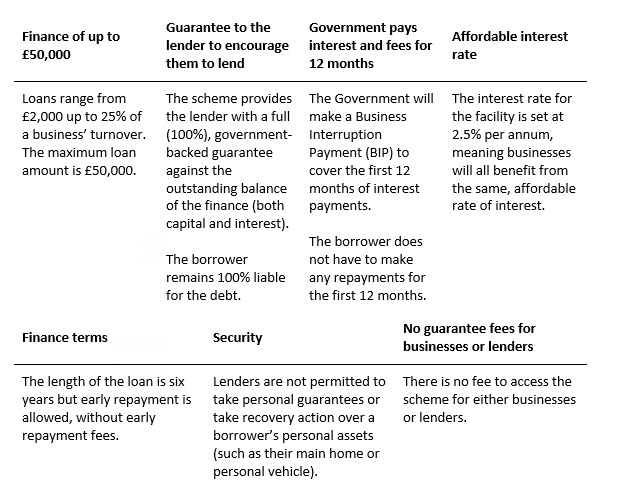

Key Features of the BBLS:

Please do not hesitate to contact us should you wish to discuss the Coronavirus Bounce Back Loan further.

Coronavirus Bounce Back Loan

The Chancellor has announced The Bounce Back Loan scheme which will help small and medium-sized businesses to borrow between £2,000 and £50,000.

The government will guarantee 100% of the loan and there will not be any fees or interest to pay for the first 12 months.

Loan terms will be up to 6 years. No repayments will be due during the first 12 months. The government will work with lenders to agree a low rate of interest for the remaining period of the loan.

The scheme will be delivered through a network of accredited lenders.

Who can apply?

You can apply for a loan if your business:

• is based in the UK

• has been negatively affected by coronavirus

• was not an ‘undertaking in difficulty’ on 31 December 2019

Who cannot apply?

The following businesses are not eligible to apply:

• banks, insurers and reinsurers (but not insurance brokers)

• public-sector bodies

• further-education establishments, if they are grant-funded

• state-funded primary and secondary schools

Is your business claiming funding via the CBILS?

You cannot apply if you are already claiming under the CBILS.

If you have already received a loan of up to £50,000 under CBILS and would like to transfer it into the Bounce Back Loan scheme, you can arrange this with your lender until 4 November 2020.

How to apply?

The Bounce Back Loan scheme will launch on 4 May 2020.

We are ourselves issuing regular updates via our website and e-mail cannons. If you are not receiving these and would like to be added to the list please e-mail [email protected] with the subject “Add me to your COVID-19 e-mails”.