Changes to the CJRS

The Coronavirus Job Retention Scheme will close on 31 October 2020.

From 1 July, employers can bring furloughed employees back to work for any amount of time and any shift pattern, while still being able to claim CJRS grant for the hours not worked.

From 1 August 2020, the level of grant will be reduced each month. To be eligible for the grant employers must pay furloughed employees 80% of their wages, up to a cap of £2,500 per month for the time they are being furloughed.

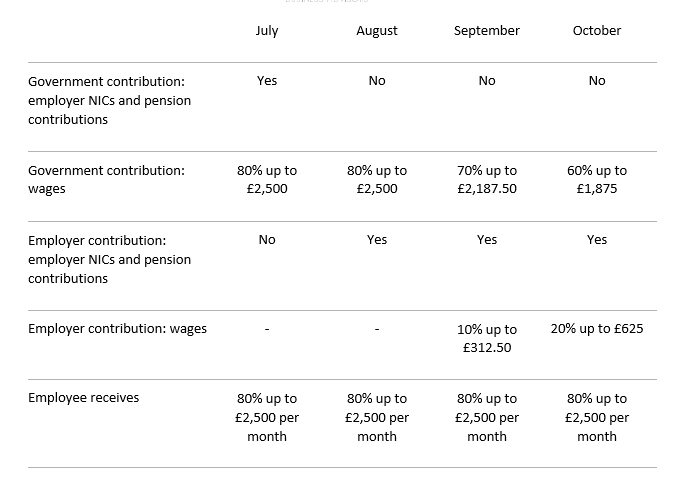

The timetable for changes to the scheme is set out below. Wage caps are proportional to the hours an employee is furloughed. For example, an employee is entitled to 60% of the £2,500 cap if they are placed on furlough for 60% of their usual hours:

- There are no changes to grant levels in June.

- For June and July, the government will pay 80% of wages up to a cap of £2,500 for the hours the employee is on furlough, as well as employer National Insurance Contributions (ER NICS) and pension contributions for the hours the employee is on furlough. Employers will have to pay employees for the hours they work.

- For August, the government will pay 80% of wages up to a cap of £2,500 for the hours an employee is on furlough and employers will pay ER NICs and pension contributions for the hours the employee is on furlough.

- For September, the government will pay 70% of wages up to a cap of £2,187.50 for the hours the employee is on furlough. Employers will pay ER NICs and pension contributions and top up employees’ wages to ensure they receive 80% of their wages up to a cap of £2,500, for time they are furloughed.

- For October, the government will pay 60% of wages up to a cap of £1,875 for the hours the employee is on furlough. Employers will pay ER NICs and pension contributions and top up employees’ wages to ensure they receive 80% of their wages up to a cap of £2,500, for time they are furloughed.

Employers will continue to able to choose to top up employee wages above the 80% total and £2,500 cap for the hours not worked at their own expense if they wish. Employers will have to pay their employees for the hours worked.

The table shows Government contribution, required employer contribution and amount employee receives where the employee is furloughed 100% of the time.

Wage caps are proportional to the hours not worked.

Claim periods

There is effectively a new CJRS in place for furlough periods from 1 July 2020. Furlough periods that straddle 1 July are treated as ending on 30 June 2020 and then restart under the new scheme on 1 July. Two separate claims will be needed for such straddling furloughs, with furlough days up to 30 June 2020 to be included in the June claim.

Claims under the existing CJRS scheme must be made by 31 July. Claims under the new CJRS cannot be made until 1 July.

If an employer wishes to claim for furlough periods in both June and July, they must make two separate claims for the June furlough and the July furlough. However, claims for furlough periods completed up to 30 June should be submitted before any claims made in respect of periods from 1 July 2020.

Under both the new and old CJRS, claims cannot be made more than 14 days before the end date of the claim, so claims with an end date of 31 July cannot be made until 18 July.

Only one claim per PAYE scheme is permitted, which must include all pay frequencies.

Claims must start and end within the same calendar month because the rules are changing from the beginning of each month. Also claim periods cannot be shorter than a week.

Who can claim from 1 July?

An employee can only be included in the claim from the 1 July if they had been furloughed for a minimum of 21 days at any point between 1 March 2020 to 30 June 2020; for example, an employee furloughed for three weeks in May, but who then returned to work can be included in a claim from 1 July.

Furlough periods

Any furlough periods up to 30 June must last at least 21 days, but those periods can be extended by any number of days. However, where an employee resumes work and then starts a new furlough period, that new furlough period must be at least 21 days.

To qualify for a claim for flexible furlough under the new CJRS, employees must have been furloughed for at least 21 days. If the employee begins a new furlough period after 10 June, they must complete a period of at least 21 days on furlough, before moving on to a flexible furlough arrangement. As stated above, any CJRS claim which straddles 30 June must be split into two to cover the June days and the July days in of the furlough period.

HMRC Validation

HMRC will validate the number of employees that can be claimed for. This must not exceed the highest number of employees that were in any claim up to and including 30 June 2020.

There are exceptions for:

- employees returning from parental leave who had not been included in a claim up to the 30 June.

- employees who have been moved to a new PAYE scheme as a result of a scheme reorganisation after 10 June, but had been in a claim under their previous PAYE scheme between 1 March 2020 and 30 June 2020

- employees transferred under the TUPE rules into a business due to a change of ownership or a compulsory liquidation after 10 June 2020, but who had been in a claim under their previous PAYE scheme between 1 March 2020 and 30 June 2020

There will be a facility to adjust the claim numbers to accommodate such employees.

Reporting the hours on the flexible furlough scheme

From 1 July 2020, employees can work and be furloughed in the same pay period, and even on the same day. If employers want to take advantage of this flexibility they will have to calculate all of the following for the employee:

- his or her ‘usual hours’

- actual hours worked

- furloughed hours worked

‘Usual hours’ are either:

- Contracted hours for salaried employees; or

- Specific formula for zero hours or variably paid employees

In all calculations always round up to the next whole number of hours.

Furloughed hours

To calculate an employee’s furloughed hours, deduct the actual hours worked from the usual hours. Employers will be expected to report the worked hours and the usual hours in the CJRS claims portal. Only where there are 100 or more employees in a claim can the details be submitted on a spreadsheet.

Since April 2019 employers in Great Britain have had to show the number of hours worked on payslips if pay varies based on hours worked. This requirement will apply to all employees who are flexibly furloughed from 1 July. Whilst the legislative requirement is to show the working hours as a total for the pay period, employers may choose to show furloughed hours as well for transparency.

The £2,500 wage cap continues to apply for July and August. This applies to each employment and is not aggregated, it is prorated to the hours in the pay period that the employee is furloughed, with this apportionment based on calendar days. The employer’s NIC threshold and pension threshold will also be apportioned.

National Minimum Wage

This will be an important consideration from 1 July for any employees who are working as well as being furloughed for part of the pay period. They must be paid national minimum wage (NMW) for each hour of work and training. Care must be taken for apprentices in particular.

Important to note

Be clear about what is required to be paid through the payroll, as per the employee’s terms and conditions for the hours worked, and the amount that can be claimed for under the CJRS for the number of furloughed hours. What an employer can claim under CJRS may be less than they had expected, and less than they are due to pay through the payroll.

Record keeping

As with any aspect of CJRS, the employer must keep a written agreement confirming the furlough arrangement. Records of these employee agreements must be kept for until 30 June 2025.

CJRS Claim Corrections Facility Now Available

HMRC has added a facility to the Coronavirus Job Retention Scheme (CJRS) claims process which allows employers to declare over-claims of grants, and offset the excess grant claimed.

Where the employer has over-claimed the CJRS grant in an earlier claim they must adjust the amount claimed in the current claim, to take account of the amount of over-claim, and tick a box to say a correction has been made.

HMRC guidance states that the employer should keep records of the amounts of the CJRS claims, the claim period for each employee, the calculations and any corrections made, for six years.

The online correction facility only applies to over-claims of CJRS grants. If the employer has under claimed the CJRS grant due, then the employer should contact HMRC on the coronavirus technical line: 080 0024 1222. The HMRC officer will be able to put through a parallel claim for the extra grant due and provide a claim’s reference number during the call.

Where directors do not notify HMRC of the over claim of a CJRS grant, a penalty may be applied under the failure to notify rules, treating the error as deliberate and concealed. This would mean a penalty would be imposed at 30% to 100% of the overpayment if the employer voluntarily disclosed, or 50% to 100% of the overpayment where the disclosure was prompted by HMRC.

HMRC is expected to take a light-touch approach to penalties, and not penalise for genuine errors.

Flexible Furlough from 1 July under revised CJRS

The Chancellor has announced that changes to the CJRS will apply a month earlier than expected. From 1 July the scheme will allow part-time working, but staff must have been furloughed by 10 June to be eligible

From 1 July 2020, businesses will be given the flexibility to bring furloughed employees back part time. This is a month earlier than previously announced to help support people back to work. Individual firms will decide the hours and shift patterns their employees will work on their return, so that they can decide on the best approach for them – and will be responsible for paying their wages while in work.

From August 2020, the level of government grant provided through the job retention scheme will be slowly tapered to reflect that people will be returning to work. That means that for June and July the government will continue to pay 80% of people’s salaries. In the following months, businesses will be asked to contribute a modest share, but crucially individuals will continue to receive that 80% of salary covering the time they are unable to work.

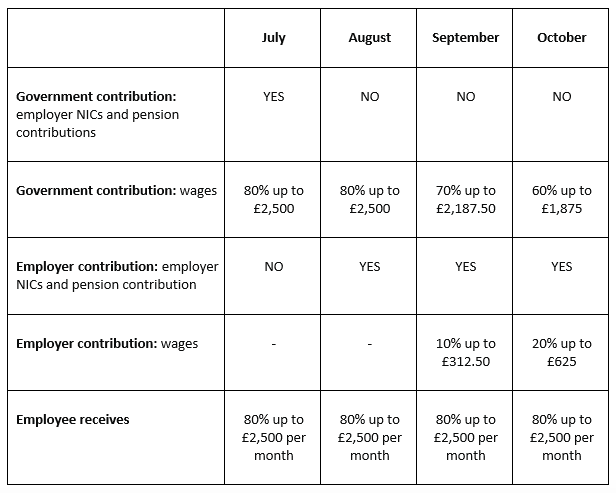

The scheme updates mean that the following will apply for the period people are furloughed:

June and July: The government will pay 80% of wages up to a cap of £2,500 as well as employer National Insurance (ER NICS) and pension contributions. Employers are not required to pay anything.

August: The government will pay 80% of wages up to a cap of £2,500. Employers will pay ER NICs and pension contributions – for the average claim, this represents 5% of the gross employment costs the employer would have incurred had the employee not been furloughed.

September: The government will pay 70% of wages up to a cap of £2,187.50. Employers will pay ER NICs and pension contributions and 10% of wages to make up 80% total up to a cap of £2,500. For the average claim, this represents 14% of the gross employment costs the employer would have incurred had the employee not been furloughed.

October: The government will pay 60% of wages up to a cap of £1,875. Employers will pay ER NICs and pension contributions and 20% of wages to make up 80% total up to a cap of £2,500. For the average claim, this represents 23% of the gross employment costs the employer would have incurred had the employee not been furloughed.

Employers will be required to submit data on the usual hours an employee would be expected to work in a claim period and actual hours worked. Employees who believe they are not getting their 80% share can also report any concerns to the HMRC fraud hotline. HMRC will not hesitate to take action against those found to be abusing the scheme.

Around 40% of employers have not made a claim for employer NICs costs or employer pension contributions and so will be unaffected by the change in August if their employee’s employment patterns do not change.

Many smaller employers have some or all of their employer NIC bills covered by the Employment Allowance so will not be significantly impacted.

Around 25% of CJRS monthly claims are below the thresholds where employer NICs and automatic enrolment pension contributions are due, and so no employer contribution would be expected for these payments to furloughed employees in August.

The scheme will close to new entrants on 30 June, with the last three-week furloughs before that point commencing on 10 June. This means the final date by which an employer can furlough an employee for the first time will be 10 June for the current three week furlough period to be completed by 30 June. Employers will have until 31 July to make any claims in respect of the period to 30 June.

From 1 July, employers will be able to agree any working arrangements with previously furloughed employees.

When claiming the CJRS grant for furloughed hours; employers will need to report and claim for a minimum period of a week, for grants to be calculated accurately across working patterns.

The table below summarises the changes to the scheme and implications for the employer and employee:

Coronavirus Job Retention Scheme (CJRS) and Holiday Pay

Holiday entitlement

Workers who have been placed on furlough continue to accrue statutory holiday entitlements, and any additional holiday provided for under their employment contract.

If employers wish to reduce holiday entitlement below the 5.6 week legal minimum this needs to be done as an amendment to the worker’s contract.

Requesting or changing holiday

Employers can:

- require workers to take holiday

- cancel a worker’s holiday, if they give enough notice to the worker

The required notice periods are:

- double the length of the holiday if the employer wishes to require a worker to take holiday on particular days

- the length of the planned holiday if the employer wishes to cancel a worker’s holiday or require the worker not to take holiday on particular dates

Employers can ask workers to take or cancel holiday with less notice but need the workers’ agreement to do so.

These notice periods are in advance of the first day of the holiday, and the notice must be given before the notice period starts. For example, if an employer wanted to prevent a worker taking a week’s holiday, they would have to give notice earlier than 1 week before the first day of the holiday. For the purposes of calculating the notice period, any uninterrupted period of holiday counts as a single period. These rules on notice periods can be altered by a binding written agreement between the employer and the worker.

Requesting or changing holiday – Furloughed workers

Workers on furlough can take holiday without disrupting their furlough. The notice requirements for their employer requiring a worker to take leave or to refuse a request for leave continue to apply. Employers should engage with their workforce and explain reasons for wanting them to take leave before requiring them to do so.

If an employer requires a worker to take holiday while on furlough, the employer should consider whether any restrictions the worker is under, such as the need to socially distance or self-isolate, would prevent the worker from resting, relaxing and enjoying leisure time, which is the fundamental purpose of holiday.

Bank holidays

There is no statutory right to time off for bank holidays. Employers can include bank holidays as part of a workers’ statutory holiday entitlement if they choose, but do not have to do so.

Where necessary, employers can require workers who would usually take bank holidays as holiday to work instead, using the standard notice periods. Employers must still ensure that the workers receive their statutory holiday entitlement for the year.

Bank holidays – Furloughed workers

Where a bank holiday falls inside a worker’s period of furlough and the worker would have usually worked the bank holiday, their furlough will be unaffected by the bank holiday.

However, if the worker would usually have had the bank holiday as annual leave, there are 2 options.

- The bank holiday is taken as annual leave: If the employer and the worker agree that the bank holiday can be taken as annual leave while on furlough, the employer must pay the correct holiday pay for the worker. Employers may also require workers to take the bank holiday as annual leave with the correct notice periods.

- The bank holiday is deferred: If the employer and the worker agree that the bank holiday will not be taken as annual leave at that time, the worker must still receive the day of annual leave that they would have received. This holiday can be deferred till a later date, but the worker should still receive their full holiday entitlement.

Holiday pay

The amount of pay that a worker receives for the holiday they take depends on the number of hours they work and how they are paid for those hours. The principle is that pay received by a worker while they are on holiday should reflect what they would have earned if they had been at work and working.

Holiday pay, whether the worker is on furlough or not, should be calculated in line with current legislation, based on a worker’s usual earnings. The underlying principle is that a worker should not be financially worse off through taking holiday. Where a worker has regular hours and pay, their holiday pay would be calculated based on these hours. If they have variable hours or pay, their holiday pay is calculated as an average of the previous 52-weeks of remuneration excluding weeks in which there was no remuneration.

Holiday pay – Furloughed workers

An employer should not automatically pay a worker on holiday the rate of pay that they are receiving while on furlough, unless the employer has agreed to not reduce the worker’s pay while on furlough.

If a worker on furlough takes annual leave, an employer must calculate and pay the correct holiday pay in accordance with current legislation. Where this calculated rate is above the pay the worker receives while on furlough, the employer must pay the difference. However, as taking holiday does not break the furlough period, the employer can continue to claim the 80% grant from the government to cover most of the cost of holiday pay.

If an employer cannot afford to fund the top up for holiday pay it would be reasonable to refuse a request to take holiday at this time. As the working time regulations have been amended, annual leave can now be carried forward over the next two leave years. Salary in lieu of holiday is not permitted in any circumstances other than termination of employment.

Coronavirus Job Retention Scheme (CJRS) Extended

The Chancellor has announced the Coronavirus Job Retention Scheme will remain open until the end of October.

In a boost to millions of jobs and businesses, the Chancellor said the furlough scheme would be extended by a further four months with workers continuing to receive 80% of their current salary.

From the start of August, furloughed workers will be able to return to work part-time with employers being asked to pay a percentage towards the salaries of their furloughed staff.

The employer payments will substitute the contribution the government is currently making, ensuring that staff continue to receive 80% of their salary, up to £2,500 a month.

The scheme will continue in its current form until the end of July and the changes to allow more flexibility will come in from the start of August. More specific details and information around its implementation will be made available by the end of this month.

The government will explore ways through which furloughed workers who wish to do additional training or learn new skills are supported during this period.

Updated Coronavirus Job Retention Scheme (CJRS) as of 20 April 2020

The government has announced a major change to the (CJRS), extending the scheme to 4 months, which means the scheme will now be available up to 30 June 2020 as opposed to 31 May 2020 as originally announced.

The scheme start date remains as of 1 March 2020.

The claim will be made online via an online portal which is now opened for submissions.

HMRC will check claims made through the scheme. Payments may be withheld or need to be repaid in full to HMRC if the claim is based on dishonest or inaccurate information or found to be fraudulent.

HMRC has put in place an online portal for employees and the public to report suspected fraud in the Coronavirus Job Retention Scheme.

Updated Coronavirus Job Retention Scheme (CJRS) as of 15 April 2020

The government has announced a major change to the (CJRS), moving the cut-off date from 28 February to 19 March. To qualify for the grant, the employer must now have created and started a PAYE payroll scheme on or before 19 March 2020.

Under the change, employers are now able to claim for furloughed employees that were on their payroll scheme on or before 19 March 2020 and who were notified to HMRC on an RTI submission on or before 19 March 2020.

Employees who were employed on 28 February 2020 and on payroll (ie notified to HMRC on an RTI submission on or before 28 February) and who were made redundant or stopped working for the employer after that and prior to 19 March 2020, can also qualify for the scheme if the employer re-employs them and puts them on furlough.

Updated Coronavirus Job Retention Scheme (CJRS) as of 6 April 2020

How much your business can claim depending on the type of employees you have

Following from the guidance issued by HMRC on the CJRS, further guidance has now been issued in respect of further clarification on how to calculate a claim and clarification of what constitutes wages.

How much can you claim under CJRS?

You will need to claim for:

• 80% of your employees’ wages (even for employee’s on National Minimum Wage) – up to a maximum of £2,500. Do not claim for the worker’s previous salary.

• minimum automatic enrolment employer pension contributions on the subsidised wage

You can choose to top up your employee’s salary, but you do not have to. Employees must not work or provide any services for the business while furloughed, even if they receive a top-up salary.

Grants will be prorated if your employee is only furloughed for part of a pay period.

Claims should be started from the date that the employee finishes work and starts furlough, not when the decision is made, or when they are written to confirming their furloughed status.

The way you work out your employees’ wages is different depending on what type of contract they are on, and when they started work.

Full or part time employees on a salary

Claim for the 80% of the employee’s salary, as of 28 February 2020, before tax.

Employees whose pay varies

If the employee has been employed for 12 months or more, you can claim the highest of either the:

• same month’s earning from the previous year

• average monthly earnings for the 2019-2020 tax year

If the employee has been employed for less than 12 months, claim for 80% of their average monthly earnings since they started work.

If the employee only started in February 2020, work out a pro-rata for their earnings so far, and claim for 80%.

Employer National Insurance and Pension Contributions

You will still need to pay employer National Insurance and pension contributions on behalf of your furloughed employees, and you can claim for these too.

You cannot claim for:

• additional National Insurance or pension contributions you make because you chose to top up your employee’s salary

• any pension contributions you make that are above the mandatory employer contribution

Past Overtime, Fees, Commission, Bonuses and non-cash payments

You can claim for any regular payments you are obliged to pay your employees. This includes wages, past overtime, fees and compulsory commission payments. However, discretionary bonus (including tips) and commission payments and non-cash payments should be excluded.

Benefits in Kind and Salary Sacrifice Schemes

The reference salary should not include the cost of non-monetary benefits provided to employees, including taxable Benefits in Kind. Similarly, benefits provided through salary sacrifice schemes (including pension contributions) that reduce an employee’s taxable pay should also not be included in the reference salary. Where the employer provides benefits to furloughed employees, this should be in addition to the wages that must be paid under the terms of the Job Retention Scheme.

Normally, an employee cannot switch freely out of a salary sacrifice scheme unless there is a life event. HMRC agrees that COVID-19 counts as a life event that could warrant changes to salary sacrifice arrangements, if the relevant employment contract is updated accordingly.

Apprenticeship Levy and Student Loans

Both the Apprenticeship Levy and Student Loans should continue to be paid as usual. Grants from the Job Retention Scheme do not cover these.

National Minimum Wage

Individuals are only entitled to the National Living Wage (NLW)/National Minimum Wage (NMW)/ Apprentices Minimum Wage (AMW) for the hours they are working or treated as working under minimum wage rules.

This means that furloughed workers who are not working can be paid the lower of 80% of their salary or £2,500 even if, based on their usual working hours, this would be below their appropriate minimum wage. However, time spent training is treated as working time for the purposes of the minimum wage calculations and must be paid at the appropriate minimum wage, taking into account the increase in minimum wage rates from 1 April 2020. As such, employers will need to ensure that the furlough payment provides sufficient monies to cover these training hours. Where the furlough payment is less than the appropriate minimum wage entitlement for the training hours, the employer will need to pay the additional wages to ensure at least the appropriate minimum wage is paid for 100% of the training time.

Where a furloughed worker is paid close to minimum wage levels and asked to complete training courses for a substantial majority of their usual working time employers are recommended to seek independent advice or contact ACAS.

What you will need to make a claim

Employers should discuss with their staff and make any changes to the employment contract by agreement. Employers may need to seek legal advice on the process. If sufficient numbers of staff are involved, it may be necessary to engage collective consultation processes to procure agreement to changes to terms of employment.

To process the claim, HMRC will need:

• your ePAYE reference number

• the number of employees being furloughed

• the claim period (start and end date)

• amount claimed (per the minimum length of furloughing of 3 consecutive weeks)

• your bank account number and sort code

• your contact name

• your phone number

You will need to calculate the amount you are claiming. HMRC will retain the right to retrospectively audit all aspects of your claim.

Claim

You should make your claim using the amounts in your payroll – either shortly before or during running payroll. Claims can be backdated until the 1 March where employees have already been furloughed.

If appropriate, worker’s wages should be reduced to 80% of their salary within your payroll before they are paid. This adjustment will not be made by HMRC.

Minimum furlough periods

Any employees you place on furlough must be furloughed for a minimum period of 3 consecutive weeks. When they return to work, they must be taken off furlough. Employees can be furloughed multiple times, but each separate instance must be for a minimum period of 3 consecutive weeks.

After you have claimed

HMRC will check your claim, and if you are eligible, pay it to you by BACS to a UK bank account.

You must pay the employee all the grant you receive for their gross pay, no fees can be charged from the money that is granted.

What happens when the government ends the scheme

When the government ends the scheme, you must make a decision, depending on your circumstances, as to whether employees can return to their duties. If not, it may be necessary to consider termination of employment (redundancy).

HMRC will process all claims made before the scheme ends.

How ansteybond can help?

If you have agreed with your employees that they will be classed as “furloughed workers”, ansteybond will be able to assist with the reporting of this change to HMRC via their new portal for this scheme. Please contact Jennifer Gordon further information.

Anstey Bond HR Limited can provide assistance in respect of negotiating the change in the employees’ status, review of contracts of employment, drafting of letters to opt for the CJRS , advice on employment law related issues with working from home, GDPR issues and any other HR and employment law related query you may have. We offer a fixed rate subscription which can be paid monthly with interest free payments. Please contact Claudia Rowell for further information.

We are ourselves issuing regular updates via our website and e-mail cannons. If you are not receiving these and would like to be added to the list please e-mail [email protected] with the subject “Add me to your COVID-19 e-mails”.